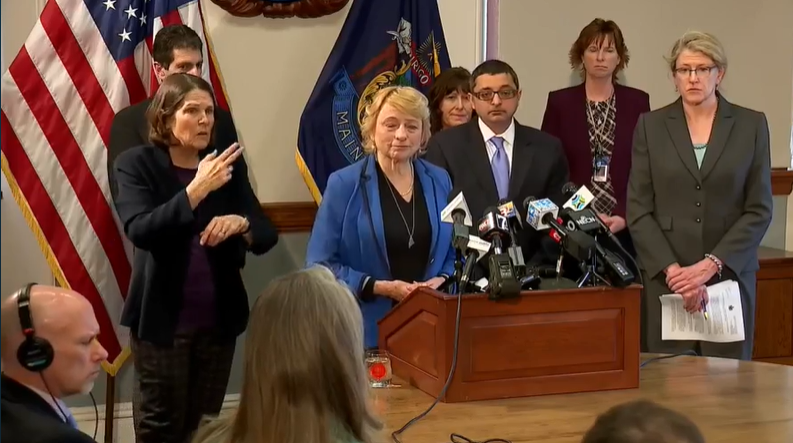

Maine’s governor has announced a series of steps designed to protect businesses and workers in the state as closures mount due to the new coronavirus.

Gov. Janet Mills says Sunday she has submitted emergency legislation to temporarily expand eligibility for unemployment insurance to individuals whose employment has been impacted by the virus.

She also called on the federal Small Business Administration to provide economic support loans to small businesses in the state to help them deal with loss of revenue.

“Maine’s small businesses and their workers are the backbone of our economy, and there is no question that the coronavirus is impacting them,” Mills said. “It is my hope that these actions will not only help them weather this difficult time by providing critical capital and financial support, but also provide them an important sense of relief amid the uncertainty.”

Mills said Maine is one of the first states to make the request. Up to $2 million in loans may be offered and can used for fixed debts, payroll and other bills small businesses may not be able to pay.

The bill, sponsored by Senate President Troy Jackson and House Speaker Sara Gideon, will be taken up Monday. The Maine Legislature is planning to adjourn on Tuesday.

Mills also directed the Maine Department of Economic and Community Development to examine additional ways the state can support Maine’s small businesses, including working with the Finance Authority of Maine and other potential lending partners.